A practical guide to growing your wealth

Wealth creation isn't just about accumulating assets; it's about strategically building a legacy, optimising your financial potential and navigating complexities with expert guidance. Moreover, it isn’t a secret code: while foundational principles remain, unlocking true financial freedom and multi-generational prosperity requires sophisticated planning, disciplined execution and informed decision-making.

By clearly understanding your starting point, acquiring the right assets and navigating the evolving stages of your wealth journey, you can achieve your financial goals and cultivate a secure and fulfilling future.

While the path may seem complex, remember that every step you take, no matter how small, brings you closer to your destination, and with the right support and guidance, you can unlock your full financial potential.

Building your wealth foundation

Having a clear picture of your financial landscape and an honest self-assessment is the cornerstone of creating the life you want. Understanding your current financial position and where you would like to end up will help you identify the next steps.

To begin, consider a comprehensive financial snapshot. Complete this exercise by answering the questions to help you establish a baseline of your current financial health and a starting point for where you want your wealth to be.

Essential assets for building wealth

Once you know where you stand, you can start strategically acquiring assets that will fuel your growth.

Here are some key asset classes to consider:

- Emergency fund

This is non-negotiable. Aim for 3‒6 months' worth of living expenses in a readily accessible, high-interest savings account. This provides a safety net against unexpected expenses, preventing you from derailing your long-term investment strategy by taking on high-interest debt. This also provides the ability to take advantage of opportune moments or to help navigate market fluctuations. - Retirement savings

Start early and contribute consistently to retirement accounts. Take advantage of employer matching programmes and consider tax-advantaged accounts, such as a tax-free savings account to supplement your savings.

Furthermore, exploring advanced retirement planning strategies, including optimising tax efficiency and considering diverse retirement vehicles, can result in considerable contribution and expansion of your wealth. - Property

Real estate can be a valuable asset, providing both rental income and potential capital appreciation. Beyond a primary residence, consider investment properties, commercial real estate or property trusts as part of a diversified portfolio. - Investments

Investing offers the potential for high returns and passive income. Your investment plan needs to be personalised and diversified based on your goals to grow your wealth. Exploring a broad spectrum of investment opportunities and bespoke portfolio construction can help see your long-term wealth vision come to life. - Cash and cash equivalents

While cash doesn't generate significant returns, it's essential for liquidity. Having readily available funds for emergencies or opportunities allows you to act decisively without incurring debt, which can erode wealth. - Skills and knowledge

Invest in yourself by acquiring new skills and knowledge that can increase your earning potential. This could involve taking courses, attending workshops or pursuing further education that can help you create strategic business development and leadership skills and leverage intellectual property.

How to acquire these assets

- Budgeting and saving: Create a budget that prioritises saving and investing. Track your expenses, identify areas where you can cut back and automate your savings contributions. Use the My360 add-on feature on our Banking App to help you conveniently keep track of all your assets, liabilities and risk cover.

- Debt management: Pay off high-interest debt as quickly as possible. Consider debt consolidation or balance transfers to lower your interest rates.

- Investing wisely: Do your research and understand the risks and rewards of different investment options. Consider working with a financial advisor to develop a personalised investment strategy.

- Wealth preservation: Protect your wealth with estate planning and a Will, creating a shield around your existing assets and helping maintain momentum for wealth growth that can be passed on to future generations.

- Seeking opportunities: Be proactive in seeking out opportunities to increase your income, whether through promotions, starting your own business or investing in other people.

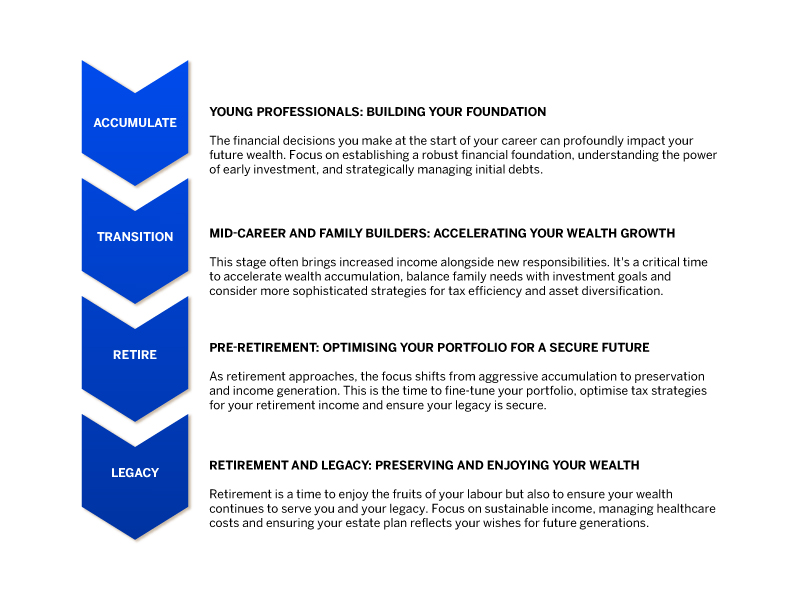

Navigating the wealth journey

The wealth-building journey isn't a one-size-fits-all process. It's a dynamic progression through different phases and life stages, each with its own unique challenges and opportunities. Understanding these phases can help you tailor your strategies effectively.

Cutting through the complexities to make informed decisions

The sheer number of financial products and services available can be overwhelming. Here's how to avoid being overwhelmed by choices:

Step 1: Define your goals

Clearly define your financial goals and priorities. This will help you narrow down your options and focus on solutions that align with your needs.

Step 2: Do your research

Research different financial products and services before deciding. Compare fees, interest rates and other terms so that you can plan with all the relevant information.

Step 3: Ask the right people for advice

Consider working with a financial advisor who can provide personalised guidance and help you navigate the complexities of the financial world.

Step 4: Start small

You don’t have to make all the decisions at once. Start with small, manageable steps and gradually increase your knowledge and confidence.

Ready to live wealthier with Africa’s Best Private Bank*?

We provide expert guidance and tailored solutions, from everyday banking to complex wealth management, all designed to help you maximise your financial potential. Meet with your Relationship Manager today.

Terms and conditions apply.

*Global Finance Awards 2025.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.