How a Relationship Manager can help you reach your goals

Juggling investments, planning for the future, and staying on top of finances can feel like a full-time job, even for the most financially savvy individuals. That is why having someone who is dedicated to navigating the complexities of wealth management can be a powerful source of support and precisely where the strategic partnership with a Private Banking Relationship Manager becomes invaluable.

What is a Relationship Manager (and how do they make life easier)?

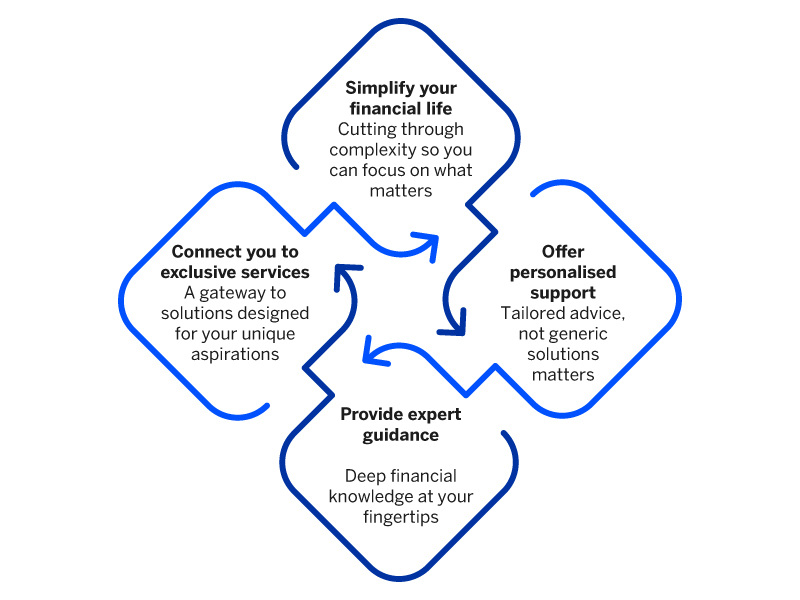

A Private Banking Relationship Manager acts as a financial guide and primary point of contact, readily accessible any time you need it. They partner with you on your wealth journey to do the following:

Your Relationship Manager takes the time to understand your financial ambitions and current situation. With deep knowledge of financial products and solutions, they help you chart a clear course to achieve your goals, but how do you truly make the most of this invaluable resource?

The Private Banking advantage: Why you need a Relationship Manager

Think of your Relationship Manager as your personal financial advocate: actively engaging with their expertise means you can optimise your finances, build a secure future and grow your wealth.

Here’s why actively engaging with your Private Banking Relationship Manager can help turn your ambitions into reality:

- One-on-one relationships and personalised partnership

Imagine having a direct relationship with someone who understands your specific needs and goals but also your ambitions, risk tolerance and your family’s future. A Relationship Manager can proactively guide you on financial services and partner with you to create a tailored experience and craft a personalised wealth strategy.

This dedicated support is complemented by a Transactional Banker for comprehensive assistance, plus round-the-clock access to our Private Client Centre, ensuring your wealth is both grown and preserved with expert care and your day-to-day banking queries are swiftly resolved. - Unlocking your wealth potential

They navigate the array of available financial solutions, identify where you are on your wealth journey and recommend relevant solutions, providing access to exclusive investment opportunities, tailored services and a network of experts, fostering a deeper understanding of your unique financial situation for optimised wealth growth. - Accessing a network of expertise

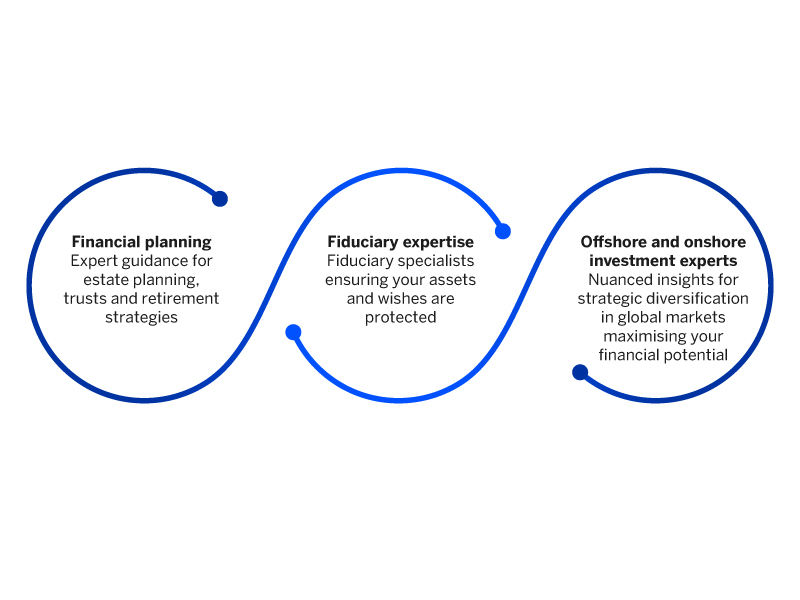

Beyond their individual expertise, your Relationship Manager acts as your dedicated connection to an extensive network of specialists, ensuring a holistic approach to optimising your wealth:

- Streamlining your finances

A Relationship Manager consolidates services such as banking, investments and lending under one point of contact, offering personalised solutions and proactive advice. This can help simplify your financial life, saving you time and effort while optimising your money management and growth. -

Maximising your Private Banking experience

Your Relationship Manager can help you take full advantage of the exclusive lifestyle, insurance, credit and UCount Rewards benefits, features and privileges offered with Standard Bank Private, helping to support your day-to-day and overall financial and wealth journey. - Protect your wealth

Your Relationship Manager can help you protect your wealth against unforeseen shocks by proactively identifying and mitigating risks by recommending tailored solutions to preserve your wealth and legacy.

They also provide guidance on fraud prevention and cybersecurity measures to protect your accounts and personal information.

Ready to live wealthier with Africa’s Best Private Bank*?

We provide expert guidance and tailored solutions, from everyday banking to complex wealth management, all designed to help you maximise your financial potential. Meet with your Relationship Manager today.

Terms and conditions apply.

*Global Finance Awards 2025.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.