Optimise your cash flow for a wealthier life

Building wealth isn't just about accumulating assets; it's about strategically managing your cash flow to maximise discretionary income and achieve your ambitions. Having available income beyond your essential living expenses is the key to unlocking financial freedom, allowing you to pursue your passions, invest in your future and build a life of purpose.

Without it, you may find yourself trapped in a cycle where you might be earning a significant salary, but you’re living paycheque to paycheque, limiting your ability to save, invest and achieve your long-term goals.

As a Standard Bank Private client, whether you're a Prestige, Private, Professional or Signature Banking member, you have access to a suite of exclusive services and expertise designed to help you optimise your financial situation and unlock the potential for a wealthier, more fulfilling life.

Unlocking your money’s full potential: Understanding your current finances

The first step towards unlocking more of your income to create greater financial flexibility and freedom is a clear and honest assessment of your current financial situation. Fortunately, it doesn’t need to be a daunting experience, thanks to a range of tools and resources to make it easier.

Key areas to consider

- Tracking income and expenses: This provides a clear picture of where your money is going and where you might be overspending, allowing you to identify areas for potential savings and adjustments.

You can easily and meticulously track your money with categorised views of your income and expenses with the Money Movements add-on on our Banking App.

- Analysing debt: Review your outstanding debts, including credit cards, loans and mortgages. Understand the interest rates you're paying and explore opportunities for consolidation or refinancing to reduce your monthly payments.

Use our financial calculators to get an estimate of the long-term impact of your debt on your overall financial health and what changes in debt repayments could mean for your future spending power and wealth creation.

- Identifying financial gaps: Recognising areas where your current financial strategies may not be sufficient to meet your long-term financial needs and then putting plans into place to rectify them are essential to achieving your goals and securing your financial future.

Are you adequately saving for retirement? Do you have sufficient emergency funds? Are you maximising your investment potential? By identifying these shortcomings, you can create a roadmap to take corrective action, increase savings, reduce debt or adjust your investment strategy, building a stronger financial foundation.

Taking advantage of Private Banking solutions

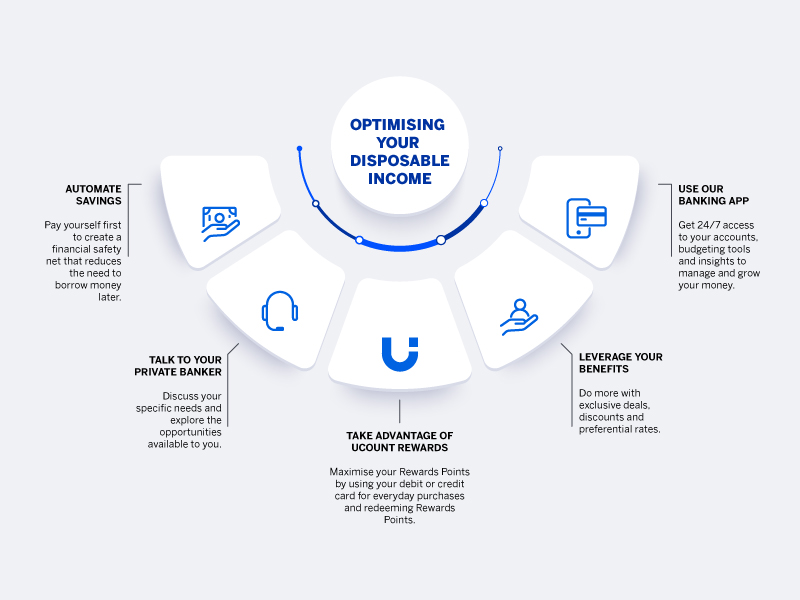

As a Private client, you have access to a range of solutions that can help you optimise your cash management and unlock more of your income so you can do more with your money:

- Dedicated Private Banking Relationship Manager: You have round-the-clock access to a dedicated Private Banking team who will work with you to help you achieve your financial goals. They can provide expert guidance, personalised solutions and ongoing support.

- Capitalise on our advisory network: Our financial planners can help you create a personalised financial plan to help you build your wealth and achieve your goals.

- Leverage preferential interest rates: You get preferential interest rates on savings accounts and fixed deposits, allowing you to earn more on your savings and grow your wealth faster, thereby optimising your spendable income in the long run.

- Smart savings and investment strategies: Maximise your returns by using a diverse range of savings and investment options tailored to your specific goals and risk profile. Your Private Banker can provide expert guidance on asset allocation and investment selection.

- Exclusive banking benefits: Take advantage of the bundled benefits that make elevating your lifestyle cost-effective, from banking perks and access to credit with an Evolve Account to exclusive features, such as access to airport lounges and discounts on travel and lifestyle services.

- Turn your spending into savings: Earn UCount Rewards Points every time you use your card, shop at Rewards Retailers or pay for fuel* and earn up to 3 times* the amount of Rewards Points when you use your Private Banking Credit or Evolve Card. You can then redeem those Rewards Points for anything from groceries to fuel, savings and investments or donations to charities.

Ready to live wealthier with Africa’s Best Private Bank**?

Explore our Private Banking options and open an account today.

*Terms and conditions apply.

**Global Finance Awards 2025.

Disclaimer: This article is for information purposes only and does not constitute financial, tax or investment advice. Readers are strongly encouraged to seek financial or legal advice before making any decisions based on the content.

Standard Bank, its subsidiaries or holding company, any subsidiary of the holding company and all of its subsidiaries, make no warranties or representations (implied or expressed) as to the accuracy, completeness, or suitability of the content of this article. The use of the article and any reliance on the content is at the reader’s risk.